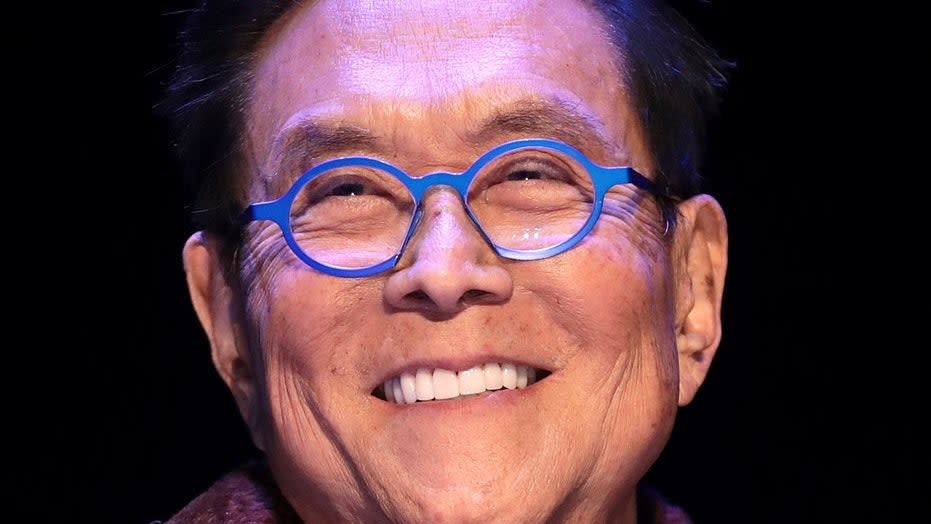

Private finance | ‘Wealthy Useless Poor Useless’ creator, Robert Kiyosaki predicts a catastrophic ‘Child Boomer Bust’ – ‘the most important bubble in historical past will wipe out the Child Boomers’ – is there any fact to his claims?

“Wealthy Dad Poor Dad” creator Robert Kiyosaki not too long ago sounded the alarm a couple of rising disaster for child boomers’ retirement financial savings.

In a social media submit, he warned that “the most important bubble in historical past will wipe out the infant boomers” as a result of they’re “the primary era with 401(ok)s.” Kiyosaki advises his followers to “purchase actual belongings earlier than the most important bubble in historical past bursts: gold, silver, bitcoin.”

Do not miss:

Kiyosaki’s dire predictions in regards to the attainable collapse of the U.S. greenback and inventory market might sound excessive, however new analysis exhibits that child boomers are fully fallacious in the case of the uncertainty of their retirement financial savings. Not baseless.

A current research by the Heart for Retirement Analysis at Boston Faculty discovered that many child boomers and subsequent generations who rely solely on 401(ok) financial savings accounts are vulnerable to working out of funds. . Economists in contrast the tempo of decline between these with conventional pensions and people with solely 401(ok) accounts, which has grow to be the norm in current many years.

Economists in contrast the attrition fee of 401(ok) accounts to conventional pensions. In keeping with senior analysis economist Gal Wittstein, retirees with pensions have traditionally maintained or expanded their nest eggs after retirement. Nonetheless, this “deep view of the previous” doesn’t apply to the 401(ok) actuality most face now.

Evaluation exhibits that 401(ok) balances are depleted considerably sooner than pensions. At ages 70 and 75, retirees with solely 401(ok)s had considerably much less financial savings than their pension counterparts. As Wettstein informed CNBC, “Folks spend a bigger portion of what they’ve once they have a 401(ok).”

Trending: Are you able to guess what number of People have efficiently retired with $1,000,000 in financial savings? The share might shock you..

This fast expense discount signifies that many 401(ok) buyers can fully exhaust their funds by age 85, even though roughly half are more likely to reside that lengthy. Due to the dearth of assured pension earnings, retirees should rely closely on withdrawals from dwindling 401(ok) balances to cowl bills.

Wettstein famous that the primary good thing about pensions is to information sustainable spending charges by making certain constant payouts. “A 401(ok) does not provide you with that,” he mentioned.

Whereas Kiyosaki’s name to desert conventional retirement accounts and put money into different belongings like valuable metals and cryptocurrencies could also be excessive, the research highlights the real-world challenges child boomers face in making certain their retirement financial savings final. Highlights the challenges. As the primary era to rely totally on 401(ok) plans, many might discover themselves in a precarious monetary place of their later years.

To keep away from working out of cash in retirement, it is vital for all generations to recurrently evaluation their financial savings and make changes as wanted. Consulting with a certified monetary advisor may also help decide whether or not your nest egg is enough to assist your required life-style in retirement. An advisor can present customized steerage on sensible return charges, funding allocations and methods to make your financial savings final, corresponding to including an annuity or reverse mortgage.

Ample retirement planning is important to keep away from the dire scenario Kiyosaki warns of. With life expectations rising, child boomers should ensure that their 401(ok)s and different financial savings can final the gap. Whereas his name to put money into unconventional belongings could also be controversial, Kiyosaki’s underlying message underscores the significance of taking your retirement safety significantly.

Learn subsequent:

*This data isn’t monetary recommendation, and private steerage from a monetary advisor is advisable to make well-informed selections.

Jeannine Mancini has written about private finance and investing for the previous 13 years in a wide range of publications together with Zacks, The Nest and eHow. He isn’t a licensed monetary advisor, and the content material herein is for informational functions solely and doesn’t represent, and isn’t meant to represent, funding recommendation or any funding service. Whereas Mancini believes that the data contained herein is dependable and has been obtained from dependable sources, no illustration, guarantee or legal responsibility, expressed or implied, is made as to the accuracy or completeness of the data.

Supercharge your inventory market sport with the “Energetic Investor’s Secret Weapon” #1 “Information and All the things Else” Buying and selling Software: Benzinga Professional – Click on Right here to Begin Your 14-Day Trial Now!

Get the newest inventory evaluation from Benzinga?

This text ‘Wealthy Useless Poor Useless’ creator, Robert Kiyosaki, predicts a catastrophic ‘Child Boomer Bust’ – ‘the most important bubble in historical past will wipe out the Child Boomers’ – is there any fact to his claims? Initially revealed on Benzinga.com.

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Robert Kiyosaki

Supply hyperlink

Associated Search Question:-

Private finance information

Private finance information right this moment

Private finance information in india

private finance information in hindi

mint private finance india

mint cash newspaper

mint information

monetary categorical private finance

private finance india reddit

Private finance replace

Private finance replace right this moment

Private finance replace pdf

Private finance replace india

private finance information india

private finance information in hindi

private finance blogs india

mint private finance india

monetary categorical private finance

#Wealthy #Useless #Poor #Useless #creator #Robert #Kiyosaki #predicts #catastrophic #Child #Boomer #Bust #largest #bubble #historical past #wipe #Child #Boomers #fact #claims